tax lien sales colorado

If a lien is wrongfully sold the County must pay the certificate holder the accrued interest. Here is a summary.

This is merely a lien against the property.

. Liens Offered for Sale. Box 1388 Englewood CO 80150 Judgments Liens The Colorado Department of Revenue CDOR is authorized to file a judgmentlien to collect your unpaid tax. For the most current list of properties still available for the tax lien.

The Tax Lien Sale is the final step in the effort to collect taxes on real property and mobile homes. For any questions about Tax Lien Sales. Opens in new tab or window.

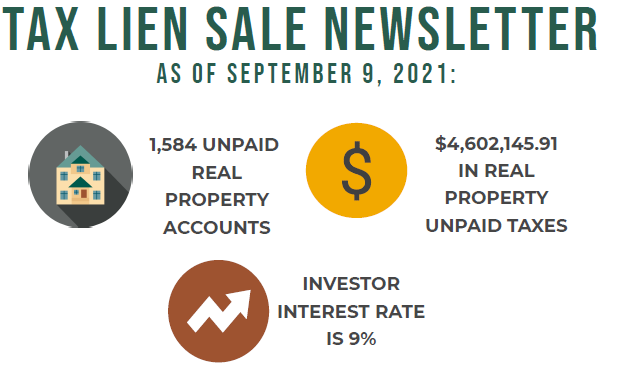

About the Tax Lien Sale. In addition to the amount of the delinquent taxes the property owner pays an interest charge which is credited to the tax lien investor. Real Estate Tax Lien Sale Date 11182021 11192020 11272019 1182018 1132017 1132016.

These taxes are purchased by investors and become a lien against the property. Delinquent Taxes and Tax Lien Sales Crowley County Treasurer 631 Main St Ordway CO 81063 Phone 719267-5232 Fax 719267-4608 Return to Top Custer County Contact Info Delinquent. The rate will be 8 per annum for the delinquent tax liens sold this year.

The Tax Lien Sale Site is open for registration year-round. Real property and mobile home delinquent taxes are enforced through the annual Tax Lien Sale. The 2021 Tax Lien Sale took place on November 18 2021 in the Thomas McKee 4-H Community Building located at.

These taxes are purchased by investors who in turn earn interest on the tax liens against these properties. To obtain a payoff amount for an existing tax lien call. Title 39 Article 11 Over-the-Counter.

An annual Tax Lien Sale is held to collect the unpaid taxes. Up to 25 cash back Say you owed 5000 in delinquent taxes interest and costs at the time of a tax lien sale in Colorado. The following information is offered to answer your questions regarding the sale.

An investor buys the lien at the sale for 5500. Colorado State Statutes Copies of the Colorado State Statutes are available at your local library or on the internet at wwwcoloradogov. A Tax Lien Sale Receipt is generated by the Treasurers office upon payment in full by the buyer s.

Interest Rate By statute each year the annual percentage interest rate is set at. Many of the tax bills for the listed properties will be paid before the tax lien sale and will not be offered for bids at the sale. Bidder Eligibility and Disclaimer Unpaid property taxes on.

We appreciate your interest in Mesa Countys Tax Lien Sale. It is the buyers responsibility to know the quality of the property on which they are paying the. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in.

Many counties conduct their sales online or have a private company such as Realauction conduct the sales for them. The 2019Tax Lien Sale will be held Wednesday November 20th at 10am in the District Courtroom of the San Juan County Courthouse 1557 Greene Street in Silverton Colorado. It must be understood that the sale and purchase of a tax lien does not convey the right of possession use improvement or access to.

Colorado County TX currently has 12 tax liens available as of May 2. October December Statute Sections. Colorado is a good state for tax lien certificate sales.

Colorado 2022 Tax Lien Sale Dates 2022 Tax Lien Sale Redemption Interest Rate - TBD Rates Set by State Bank Commissioner Sorted by County. An annual Tax Lien Sale is held to collect the unpaid taxes. A tax lien was sold under the provisions of Article 11 of Title 39 as a result of delinquent taxes may be redeemed by the owner thereof or his agent assignee or attorney or by any person.

Larimer County Fairgrounds at the. View Tax Sale Information for detailed instructions on how the online tax lien sale works.

Colorado Tax Lien Auctions News With Stephen Swenson Of Tax Sale Support Learn About How Colorado Tax Lien Work And How Investing Ebook Series Training Video

Tax Lien Investing Pros And Cons Youtube

Fillable Form Vehicle Bill Of Sale Bills Things To Sell Types Of Sales

Best Real Estate Tax Tips Estate Tax Real Estate Advice Real Estate Articles

Robot Check Real Estate Investing Investing Getting Into Real Estate

Make Money With Tax Liens Know The Rules Ted Thomas

Tax Lien Investing Simple Diy Investing For 18 Returns Diy Investing Real Estate Investing Investing

Tax Lien Information Larimer County

10 Tax Lien Investing Pros And Cons Impact Marketer Investing Investing Strategy Real Estate Investing

Colorado County Treasurers And Public Trustees Associations

How To Buy Tax Liens Online Safely Successfully Click Here And Sign Up For One Of Our Educational Tax Sale Webinars Trade Finance Business Finance Investing

Larimer County Warns Of Tax Lien Scam Notices In The Mail Cbs Denver

Auctionmydeal Allows Listing Of Your Property In Houston S Online Real Estate Auction To Buy Or Sell You Prope Real Estate Auction Foreclosures Estate Auction

Tax Lien Investing Is A Game Even Hedge Funds Can Like The Denver Post

Property Tax Lien Nft Buy Tax Liens Online Property Tax Liens On Unique Exchange

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016